Nigeria’s non-oil export sector has witnessed an unprecedented rise, hitting a record N4.8 trillion in the first half of 2025, according to official data from the National Bureau of Statistics (NBS) and the Nigerian Export Promotion Council (NEPC).

However, beneath this impressive growth lies a worrying trend: local investors and indigenous exporters are losing out on the profits of the booming trade, as foreign firms dominate key sectors due to better financing, infrastructure, and access to markets.

A Record-Breaking Surge But for Whom?

The NBS report shows that Nigeria’s non-oil exports grew by more than 390% between 2021 and mid-2025, reflecting a shift away from crude oil dependency. Products such as cocoa, sesame seeds, cashew nuts, hibiscus flowers, and solid minerals now form the backbone of the country’s export drive.

NEPC data also revealed that the bulk of the exports went to Asia, Europe, and other African countries, with India, Vietnam, China, and the Netherlands ranking among top destinations. The rise was fueled by the government’s diversification agenda and global demand for agricultural and mineral commodities.

Despite the growth, small and medium Nigerian exporters say they are being squeezed out by foreign operators who have more access to capital and better control of export logistics.

Funding and Policy Gaps Crippling Local Players

Dr. Ojo Ajanaku, President of the National Cashew Association of Nigeria (NCAN), said many local exporters are struggling to remain in business because of inadequate funding and unfavorable loan conditions.

“We have so many challenges. First, there is the issue of funding. We would have done more than we are doing currently, but many potential exporters among us are handicapped,” Ajanaku said.

He explained that foreign buyers often have easier access to credit and can pay cash upfront for raw materials, forcing local exporters to compete under unfair conditions.

“Sometimes, they simply come with documents to access funds in Nigerian banks. These foreigners buy cashew and other commodities and export them without filling the Nigerian Export Proceeds (NXP) Form. The bulk of the money they make goes out to their own countries’ economies,” Ajanaku added.

Industry insiders say many Nigerian banks still view non-oil export financing as risky, offering loans at interest rates of up to 25%, while their foreign competitors obtain funding at less than 5% abroad.

The Value Addition Problem

Experts believe Nigeria’s non-oil export figures, though impressive, hide the fact that most of the exports are raw commodities with little or no value addition.

Dr. Mark Ojobi, a lecturer at Yakubu Gowon University, said the real potential of the sector lies in processing.

“We are still largely exporting raw commodities. That means we are sending jobs and profits abroad. Value addition is the only way to unlock the full benefits of the export boom,” he said.

Nigeria currently exports cashew nuts, cocoa beans, and sesame seeds mostly in raw form, while countries like India and Vietnam process them into finished goods such as snacks, beverages, and oil products earning several times more than Nigeria from the same materials.

Red Tape and Port Bottlenecks

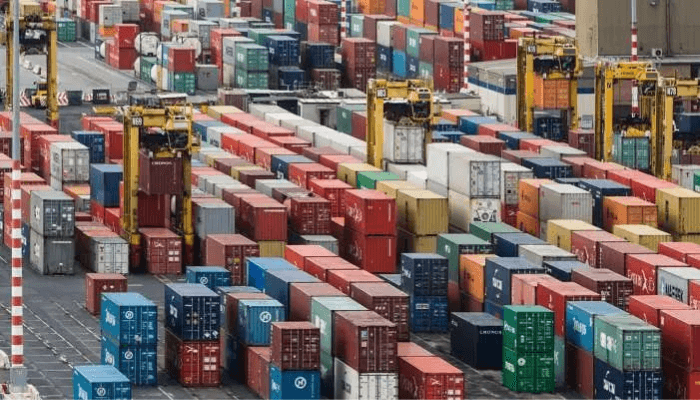

Another major concern is the inefficiency of Nigeria’s export logistics system. Exporters complain about long port delays, multiple inspections, poor coordination among regulatory agencies, and a lack of standard infrastructure such as warehouses and cold storage.

According to the NEPC, these bottlenecks reduce the competitiveness of local exporters and increase costs.

Many operators also say that bureaucratic red tape has discouraged smaller players from entering the export market, leaving it open to larger, often foreign-controlled companies.

Exchange Rate and Inflation Complications

While the export numbers look good in naira terms, analysts warn that part of the growth is simply due to naira depreciation.

Economist Adedayo Oladele noted that although exporters are earning more naira, in real terms the dollar value of exports has not grown as dramatically.

“What we are seeing is partly a currency illusion. The naira has fallen sharply, so when you convert earnings to local currency, the figures look huge. But it doesn’t necessarily mean Nigeria is exporting more value,” Oladele explained.

The Human Impact: Local Farmers Left Behind

In rural areas, many farmers producing for export say they are barely benefiting from the boom.

Smallholder farmers in Kogi, Oyo, and Benue states told journalists that they sell their produce to middlemen, who in turn supply foreign companies. Because they lack access to proper storage, credit, and processing facilities, they are forced to sell early and at low prices.

“Foreign buyers send agents who offer cash immediately. Most of us cannot wait because we need money to harvest or pay workers,” said Abubakar Sule, a cashew farmer in Ogbomoso.

What Needs to Change

Experts say Nigeria must move beyond exporting raw goods if the non-oil boom is to translate into real national wealth.

Policy analysts and export associations have proposed several key reforms:

- Export Financing Reform: Create special low-interest export development loans through the Bank of Industry and development banks to support indigenous exporters.

- Ease of Doing Business: Streamline export documentation, cut port processing time, and digitalize NXP forms to reduce manual corruption.

- Support for Value Addition: Provide tax incentives and subsidies for local processing plants and agro-industrial parks.

- Trade Infrastructure Development: Improve rural road networks, cold storage, and power supply to boost local production capacity.

- Currency and FX Policy Stability: Stabilize the naira to make export planning predictable and reduce the temptation to underreport proceeds.

Government’s Position

The NEPC Executive Director, Nonye Ayeni, acknowledged the challenges facing indigenous exporters but maintained that the sector is “on the right path.”

According to her, the government’s Renewed Hope Agenda includes programs to expand export financing, promote value addition, and simplify regulations.

“Non-oil exports are key to Nigeria’s economic diversification. We are working with banks and other agencies to ensure that local exporters are not left behind,” Ayeni said.

The Bottom Line

Nigeria’s non-oil export figures may show a remarkable success story on paper, but the benefits are not equally shared.

While foreign companies reap large profits, local exporters and farmers remain trapped by limited funding, poor infrastructure, and systemic inefficiencies.

For the non-oil boom to deliver genuine prosperity, policymakers must act fast to make it inclusive ensuring that Nigerian exporters, not just foreign players, own the next phase of the country’s trade revolution.