The Federal Government has suspended the issuance of implementation guidelines for Nigeria’s new tax laws, citing uncertainty over the final and legally binding version of the legislation currently in circulation. The development has deepened concerns around the rollout of the ambitious tax reforms signed into law by President Bola Ahmed Tinubu and scheduled to take effect on January 1, 2026.

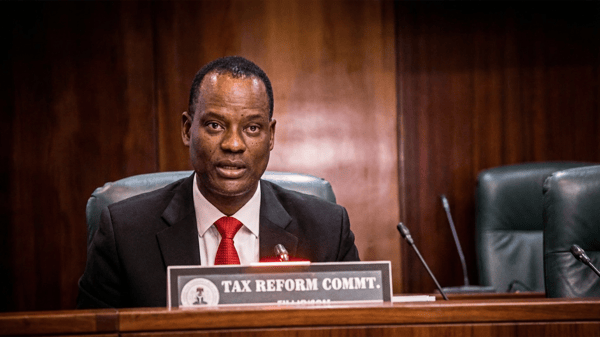

The disclosure was made by Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, who said the government would not proceed with issuing operational guidelines until all discrepancies surrounding the final version of the tax laws are resolved.

Oyedele’s position comes against the backdrop of an ongoing controversy at the National Assembly, where lawmakers have raised alarms over alleged differences between the tax bills passed by parliament and the versions later gazetted by the Federal Government.

Speaking on the matter, Oyedele stressed that implementation guidelines must be grounded in a clear and uncontested legal framework.

According to him, releasing guidelines when there is doubt about the exact content of the law could expose the reforms to litigation and undermine investor and public confidence.

“Guidelines derive their authority strictly from the law,” Oyedele explained, noting that issuing them without certainty over the final text would be irresponsible and potentially unlawful.

The paused guidelines were expected to provide clarity on key areas such as tax compliance procedures, exemptions, enforcement mechanisms, timelines, and administrative responsibilities under the new regime information eagerly awaited by businesses, tax professionals, and sub-national governments.

President Tinubu recently signed four major tax reform bills into law, describing them as the most significant overhaul of Nigeria’s tax system in decades. The laws include:

- Nigeria Tax Act

- Nigeria Tax Administration Act

- Nigeria Revenue Service (Establishment) Act

- Joint Revenue Board (Establishment) Act

The reforms seek to simplify tax compliance, harmonise revenue collection, eliminate multiple and overlapping taxes, and expand Nigeria’s tax base across federal, state, and local government levels under a single coordinating authority, the Nigeria Revenue Service (NRS).

Government officials argue that the reforms are critical to boosting Nigeria’s low tax-to-GDP ratio, which remains below the African average, and to reducing dependence on borrowing to fund public spending.

The reform process, however, has been overshadowed by claims that the versions of the tax laws gazetted by the Federal Government contain provisions not approved by the National Assembly.

In response, the House of Representatives constituted an ad hoc committee to investigate the alleged discrepancies and determine whether any illegal alterations were made after legislative passage.

Opposition parties, professional bodies, and civil society groups have warned that enforcing laws whose authenticity is in doubt could render them constitutionally vulnerable and damage public trust.

Oyedele acknowledged these concerns, saying the Presidential Committee would cooperate fully with lawmakers to ensure that the final framework reflects legislative intent and constitutional requirements.

The suspension of tax guidelines prolongs uncertainty for businesses, investors, and tax administrators who were preparing for the 2026 implementation timeline.

Analysts say the lack of clarity could complicate financial planning, pricing decisions, investment strategies, and compliance systems, especially for small and medium-sized enterprises already grappling with inflation, currency volatility, and rising operating costs.

However, some experts view the pause as a prudent move, arguing that clarity and legal certainty are more important than speed in tax administration.

Despite the controversy, the Federal Government continues to insist that the tax reforms are pro-poor and growth-driven. Officials have highlighted key provisions, including:

- Tax exemptions for small businesses

- Reduced tax burdens for low- and middle-income earners

- Lower corporate tax rates

- Elimination of nuisance and multiple taxation

Oyedele reiterated that once the legal issues are settled, the government will move swiftly to issue comprehensive guidelines and intensify public enlightenment campaigns nationwide.

Attention now turns to the outcome of the National Assembly’s investigation and whether amendments or clarifications will be required before full implementation proceeds.

For now, the government’s decision to halt the issuance of tax guidelines signals a cautious approach aimed at safeguarding the credibility and sustainability of one of its flagship economic reforms.

The suspension of tax guidelines underscores a critical lesson for governance: no reform, however well-intentioned, can succeed without legal clarity and public trust. As Nigeria prepares for a major reset of its tax system, resolving these uncertainties will be key to ensuring that the reforms deliver growth, fairness, and long-term stability.