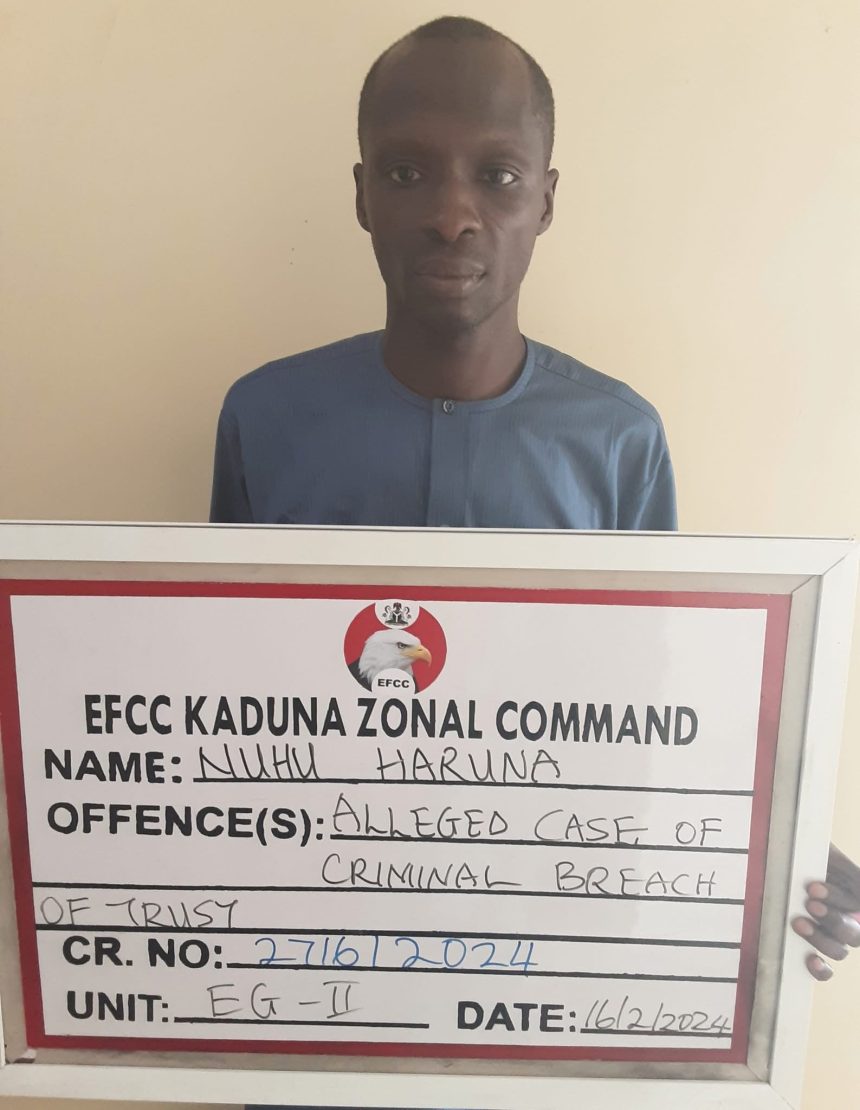

The Kaduna Zonal Directorate of the Economic and Financial Crimes Commission (EFCC) has arraigned one Captain Nuhu Haruna, Managing Director of Maphutha Oil & Gas Limited, before Justice Darius Khobo of the Kaduna State High Court over alleged involvement in a ₦1.02 billion foreign exchange fraud.

Haruna was brought before the court on a two-count charge bordering on obtaining money by false pretence and advance fee fraud, contrary to Section 1(1)(b) and punishable under Section 1(3) of the Advance Fee Fraud and Other Related Offences Act, 2006.

According to the EFCC, Haruna allegedly defrauded Alhaji Sheriff Zailani Shanono of a total sum of ₦1,020,000,000 between December 2023 and January 2024. The defendant reportedly claimed he could provide the victim with the dollar equivalent of the naira sums, amounting to $1 million in two instalments—$600,000 and $400,000.

The charge sheet revealed that in December 2023, Haruna obtained ₦782.3 million, and in January 2024, another ₦125 million, both under the pretext of converting the funds to U.S. dollars. However, after receiving the money, he allegedly presented forged evidence of dollar transfers to Shanono, which later turned out to be fake.

When the charges were read to him in court, Haruna pleaded not guilty. Prosecution counsel M.E. Eimonye requested a trial date, while defence counsel M.T. Mohammed informed the court of a bail application already filed on behalf of his client.

After hearing submissions from both counsels, Justice Darius Khobo adjourned the case to November 19, 2025, for hearing on the bail application and ordered that the defendant be remanded in a Correctional Centre pending further proceedings.

The EFCC stated that Haruna’s arrest followed a petition by the complainant, who detailed how he was introduced to the defendant and subsequently transferred the funds based on assurances of receiving their dollar equivalent in a foreign bank account. It was later discovered that the transaction documents provided by the defendant were falsified and that no actual dollar remittance was made.

The case underscores the EFCC’s renewed commitment to tackling foreign exchange-related scams and other forms of financial fraud that continue to undermine public trust and economic stability.