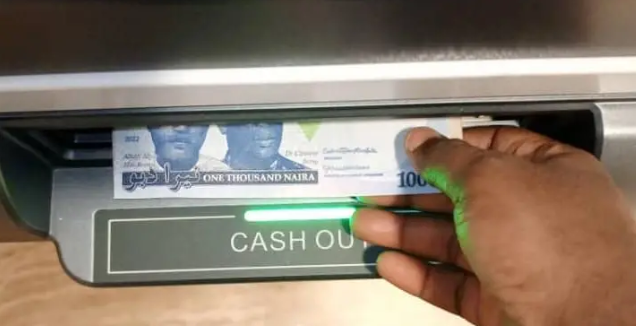

The Central Bank of Nigeria has announced plans to introduce a new regulatory policy aimed at addressing persistent ATM congestion and cash access challenges across the country.

The disclosure was made by the CBN Governor, Yemi Cardoso, through his Special Adviser, Fatai Karim, at the 2026 Committee of Heads of Bank Operations Conference held on Friday.

According to the apex bank, the proposed policy will regulate debit card issuance by ensuring that the number of cards issued by banks aligns with the capacity of their deployed ATM infrastructure. The move is intended to reduce pressure on ATMs, minimise downtime and improve the availability of cash nationwide.

The CBN noted that excessive card issuance without corresponding investment in ATM deployment has contributed significantly to overcrowded machines, frequent failures and uneven cash distribution, particularly in high-traffic locations.

The bank expressed concern that recurring ATM outages and cash shortages continue to undermine public confidence in Nigeria’s electronic payment system, even as digital transactions continue to grow rapidly across the banking sector.

“When cash access fails, whether due to prolonged ATM outages or uneven distribution, the credibility of the entire payment system is weakened,” the apex bank said.

Karim added that the CBN is currently engaging relevant industry stakeholders and expects the new policy to take effect within the next few months, possibly before the end of the second quarter of 2026.

The planned regulation is expected to improve ATM reliability, enhance cash distribution efficiency and restore confidence in electronic banking services, benefiting both banks and customers nationwide.